What to Buidl for 2021 (Part 2)

Partner at Pool2 Ventures. DeFi OG, Head Farmer, and Master of Apenomics.

This is Part 2 of the "What to Buidl for 2021" article series. If you haven't read Part 1, you may read it here.

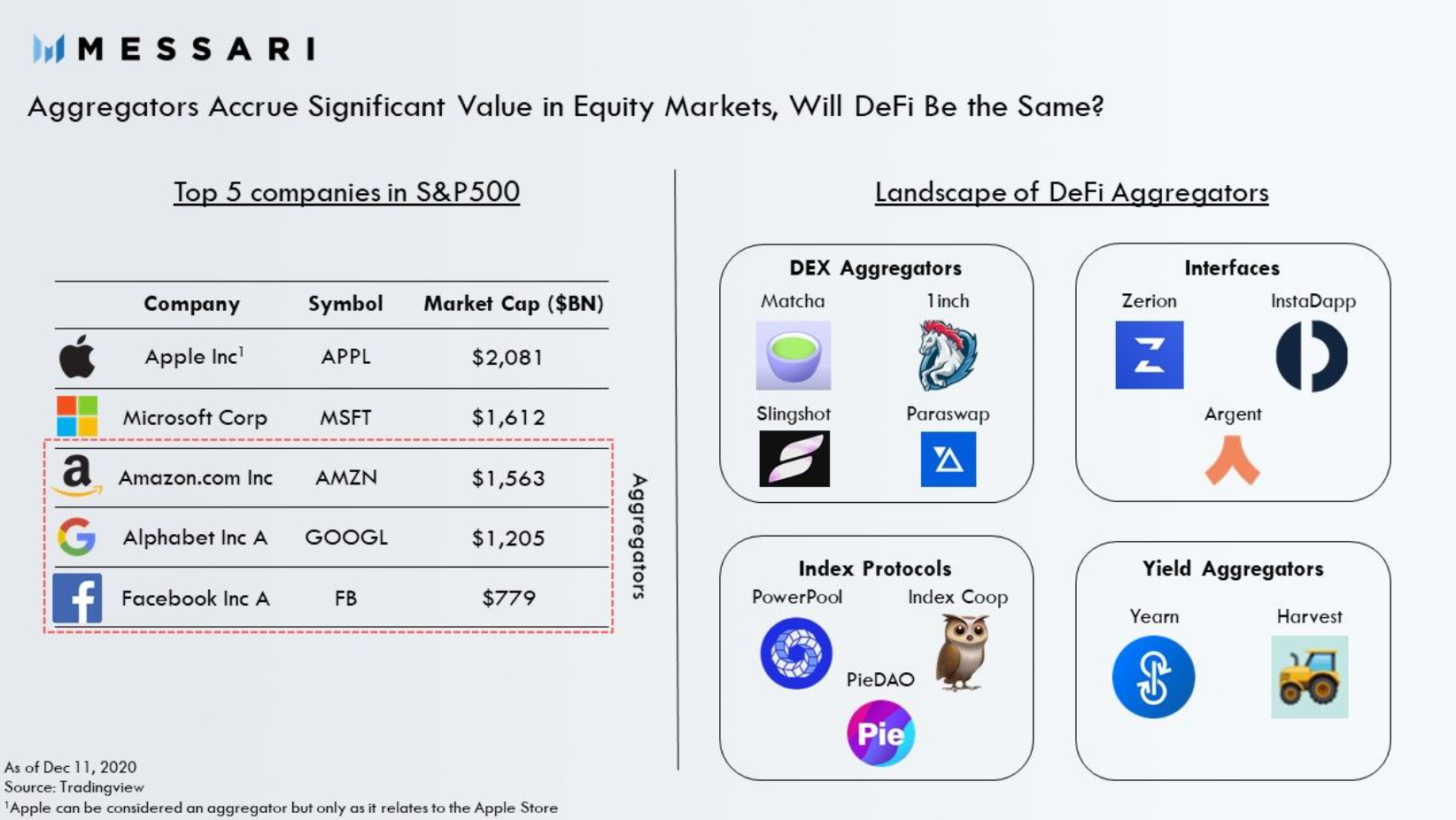

Be the DeFi Aggregator

As more L2 innovations happen and more players enter the CeFi to DeFi game, we expect the landscape to grow in complexity and the costs of finding true legitimate opportunities (tokens, yield opportunities, etc.) to go up over time.

This sets the stage for being an aggregator, to help weed out the bad actors and filter out the best opportunities to the users.

1. Yields Advisor

Aggregate yield across blockchain networks. This could be in the form of aggregating yield opportunities (index funds, cross-platform DeFi, staking as a service) or providing the most optimised yield (robo-advisor, leveraged yield farming).

Some examples of these models include:

- Yearn.finance - a suite of products in DeFi that provides lending aggregation, yield generation, and insurance on the Ethereum blockchain.

- Alpha Homora - a leveraged yield farming and leveraged liquidity providing protocol launched on Ethereum mainnet.

- APY.finance - a set of smart contracts that continuously route your funds to a portfolio of the latest-and-greatest yield farming strategies.

- DeFi Pulse Index - a capitalization-weighted index that tracks the performance of decentralized financial assets across the market.

- Staking Facilities - an enterprise-grade validator infrastructure that provides staking-as-a-service. Like rocketpool for ETH.

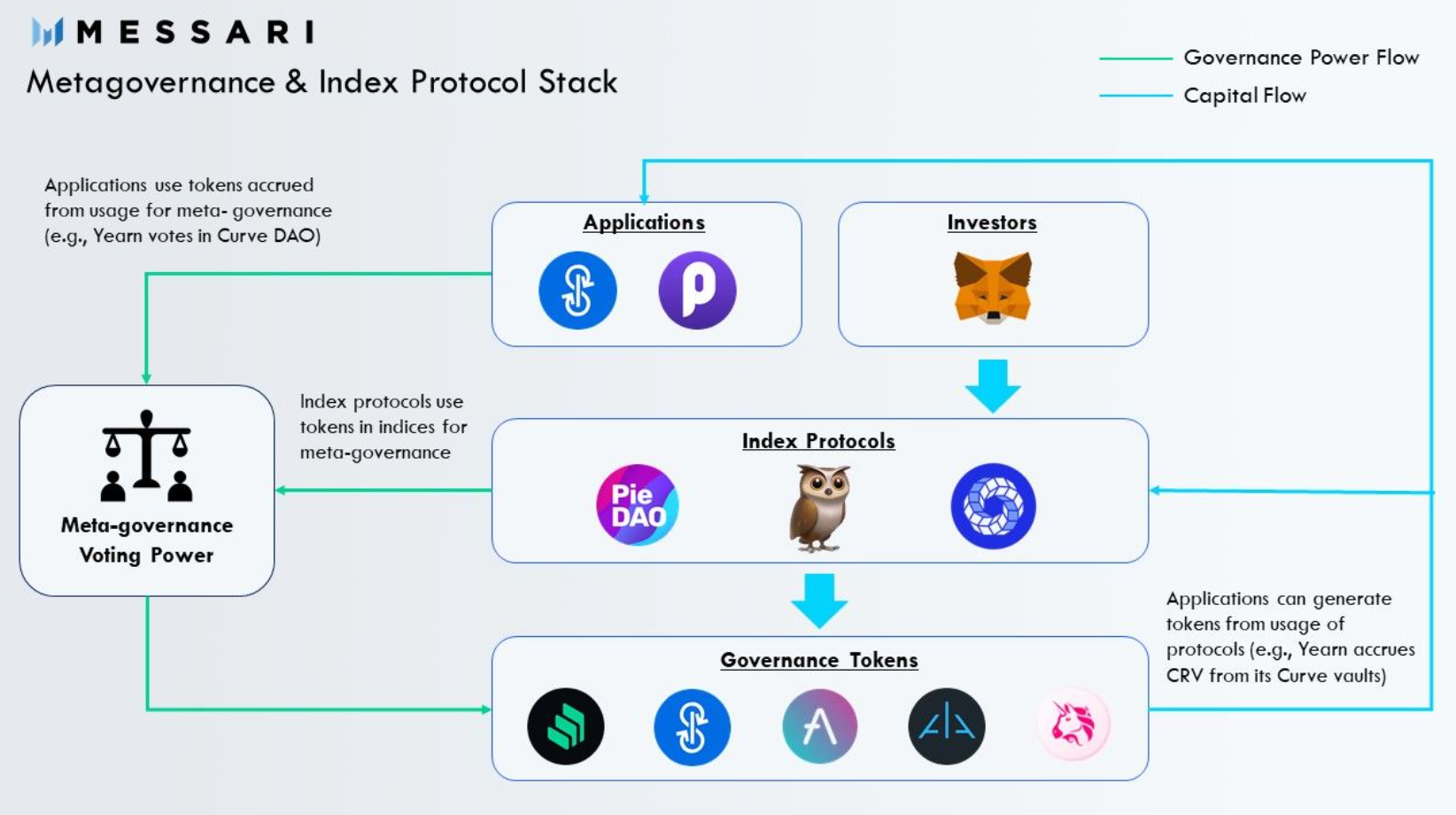

2. Meta-Governance and Delegators

With the rise of governance tokens, DeFi index funds, DAOs, and even just tokens have been created to capture the governance value of these tokens. This allows active participation from the index fund holders that can influence the returns of the index constituent tokens.

The interesting play here is that as DeFi grows, the power and value capture of large index fund holders also grows. This is one way to aggregate governance across DeFi.

A second way would be to aggregate governance via gathering power from delegators. This would involve positioning one as a trustworthy DeFi community member, like Leshner and Alameda.

Delegation behavior can also be influenced too by introducing a new token protocol that rewards voters/ delegators based on their voting/ delegation behavior/ frequency.

Here are some interesting projects in this space:

- Sybil - a governance tool for discovering delegates. Sybil maps on-chain addresses to digital identities to maintain a list of delegates.

- Boardroom - a simple interface to engage, signal, and vote on protocol decisions.

- PowerIndex - provides fund management and DeFi blue chips protocols governance.

3. Dashboard and Analytics

Aggregate data across networks and tokens. Basically building a Bloomberg for DeFi and gaining on-chain insights of token price movements. This is a no-brainer and provides the best bang for the buck if you plan to do crypto trading and investing anyways.

Some notable projects in this space:

- Nansen.ai - a tool for providing on-chain real-time analytics for crypto professionals.

- Token Terminal - provides access to standardized metrics that enable users to easily quantify and compare the performance of different crypto protocols.

- Messari - provides investors, regulators, and the public transparency to the crypto economy, with data tools for informed decision making and investment.

This is the end of this article series.