What to Buidl for 2021 (Part 1)

Partner at Pool2 Ventures. DeFi OG, Head Farmer, and Master of Apenomics.

"Ignoring technological change in a financial system based upon technology is like a mouse starving to death because someone moved their cheese" - Chris Skinner

Bitcoin (BTC) recently broke 27k and reached a new “All-Time-High'' (ATH) since 2008. This is expected to bring a lot more spotlight for enterprises getting into the game, with Ethereum (ETH) and the decentralised finance (DeFi) space following suit.

With CME announcing ETH futures contracts, we can observe a trend of heavily regulated exchanges getting green light to open up exposure for institutional and sophisticated investors to enter into the cryptocurrency and digital assets space. It will simply be a matter of time before they merge with the traditional financial space.

Significant rewards are there for those brave enough to venture into this new space. We shall collectively refer to this as DeFi, where new governance protocols, tokenomics, and smart contract automations are redefining what modern finance should look like.

In 2020 DeFi has been packed with Hollywood-like events, and so for those interested, you may read up on Messari’s Crypto Theses for 2021.

Porting CeFi to DeFi

As witnessed by the dot com era, new industry giants have leveraged the new internet technology to build out online versions of search (Google), shopping (Amazon), and payment (PayPal), etc.

With the advent of the internet magic money, we are seeing similar forces in play now for the transition of CeFi to DeFi. The thesis play is simple, and in the following we shall talk about 3 variants of this.

1. Porting tradFi to DeFi

The below chart says it all. Nothing too fancy, but the act of simply porting over existing real-world models into the DeFi space is itself a solid and robust strategy.

There are multiple ways to venture into this. One common way would be to introduce a balanced team of experts, one of which composes of strong domain knowledge (e.g. asset management, tradFi). The second group would consist of engineering (e.g. smart contracts, developers) that has the persistence to push through a testnet ready solution. The domain and engineer expert is a must, with UI/UX, researchers, and community managers forming the core peripheral team.

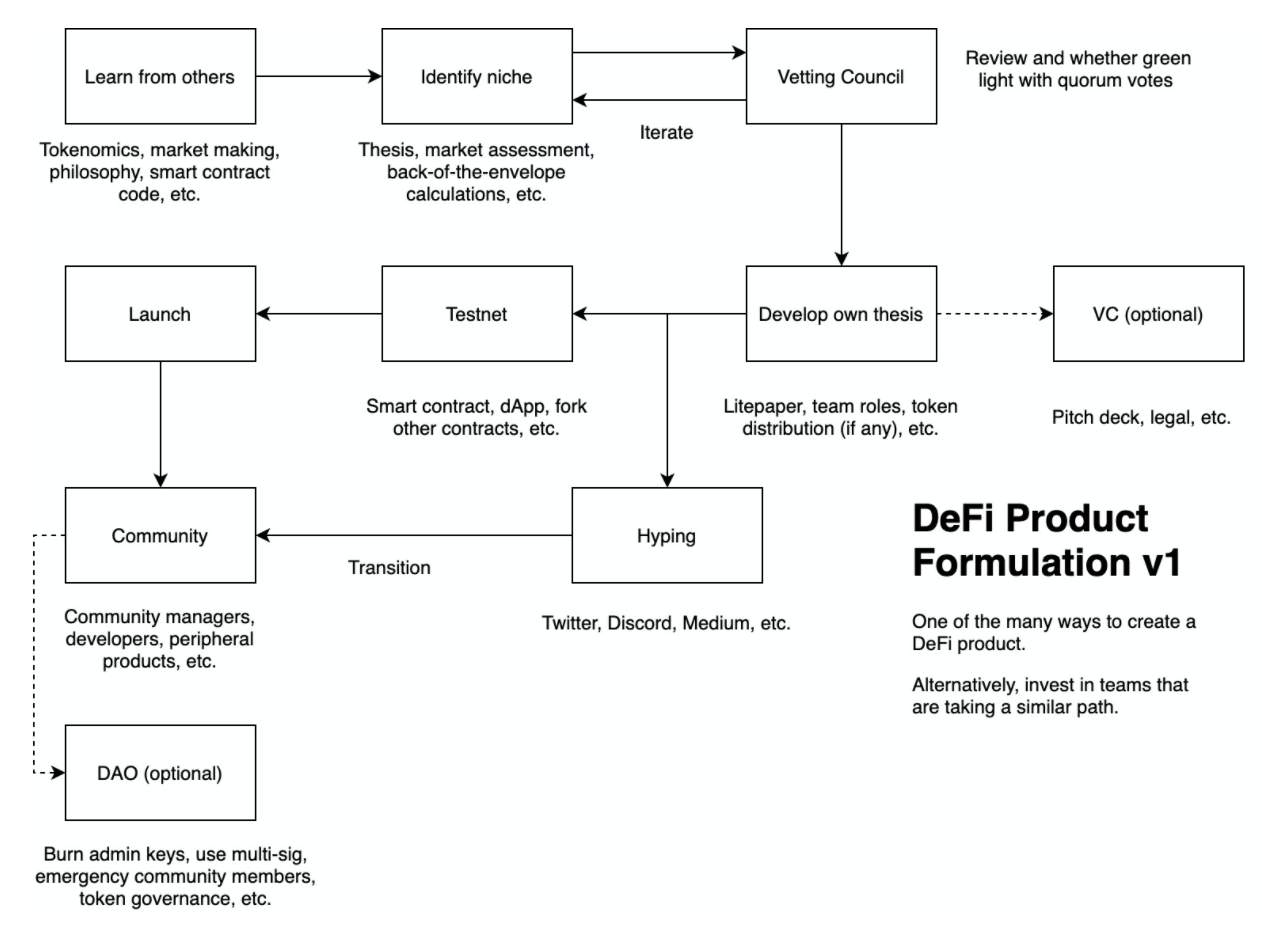

The methodology from zero to one can be something as follows.

2. Bridging the old world

While some major corporations have publicly entered into the market (e.g. MicroStrategy, Square, BlackRock), many are still on the sidelines due to not having a safe and compliant way of entering this market.

One of the most straightforward ways of bridging all these hungry institutional money into the new DeFi world would be taking the path as a VA portfolio manager and/or fund distributor. This is a solid play for those which have obtained the necessary regulatory licenses, allowing digital asset (BTC, ETH, DeFi, and NFT tokens, etc.) advisory and investment services to be provided in a direct (centralised) or indirect (non-custodial) manner. The opposite direction of luring the new world could be tokenizing real-world assets and providing stable yields of a token.

A portfolio/ platform-based approach may involve building a bridge platform where institutional clients can interact directly with stablecoins and/or separating the fiat-crypto flow.

An investment product approach may involve setting up custom index funds or strategies that provide exposure to the DeFi space for institutional clients.

3. New Transformative Models

L2 innovations such as cross-chains, optimistic rollups, and peripheral smart contracts, etc. can be studied to see whether completely transformative models and processes can be implemented for existing problems. This is different to porting as these implementations are either holding itself as a new category of solutions or deemed impossible to be executed without the L2.

This takes a longer route to discover new possibilities that can only be done with L2 innovations, but is much more rewarding in terms of product achievement and creating your moat.

Some examples of these models include:

- KeeperDAO - an on-chain liquidity underwriter for DeFi where people can pool their assets to earn passive income through liquidations, arbitrage, and other opportunities from all across DeFi.

- Keep3r Network - a decentralized keeper network for projects that need external devops and for external teams to find keeper jobs.

- API3 - provides decentralized APIs for smart contracts in a secure and cost-efficient way.

- The Graph - an indexing protocol for querying networks like Ethereum and iPFS, with open APIs where everyone can build, publish, and use.

This summarises Part 1 of this article series. Please go to Part 2 for the remaining discussions on what to buidl for 2021.